Thank you for reading our Brandon's Blog. Check out our AI insolvency bot on this page and don't forget to subscribe!

The conundrum

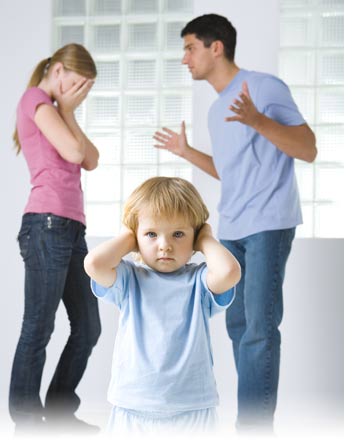

Divorce during bankruptcy Canada is the same as the old conundrum, “which arrived first; the chicken or maybe the egg”, how would one answer, marital breakdown and insolvency: which comes first? Nobody has a definitive answer because excellent arguments can be produced for both. The same is true for “divorce and personal bankruptcy which comes first”?

Every case is decided based on its unique facts. Marital breakdown and insolvency, and bankruptcy and divorce, often go hand in hand. However, a marital breakdown will not always lead to divorce if the marriage can be salvaged. However, personal bankruptcy and divorce are two separate legal processes that can be at odds with each other.

A few indisputable facts

In this divorce during bankruptcy Canada Brandon’s Blog you will find 5 indisputable facts:

- The number one reason for marital breakdown and divorce is financial issues. Divorce.com

- In a recently available study one out of every seven people who made an insolvency filing in Canada listed separation, divorce or marital breakdown as a contributing factor to their financial problems.

- One-third of all people facing insolvency problems are also going through relationship breakdown and divorce in Ontario or {a splitting up. Gail Vaz-Oxlade

- Bankruptcy won’t end all divorce financial obligations. e. g. It does indeed not end alimony or child support.

- Declaring personal bankruptcy on joint debts, even debts in a divorce will impact the other debtor.

Are you looking to reduce grief?

If creating minimal interruption on the children of the family during a marital breakdown and personal bankruptcy features prime importance to the spouse with the debts (and presumably that will be just like the spouse making the support payments), it makes sense to have at least the support terms of the divorce decided, including the making of the support order and then do an insolvency filing. The marital breakdown and bankruptcy process will not disturb any in good faith arrangements for support, but keep in mind it will affect property not already dealt with by the family law court.

What about joint debts?

One particular area that comes up in divorce during bankruptcy Canada is this common question: “If my ex files how will it affect joint liabilities? “. Family law rules are the one area of a provincial law that is left relatively unblemished by the Bankruptcy and Insolvency Act, which is a federal statute. Nevertheless, the Supreme Court of Canada has confirmed that in Provinces that are an equalization jurisdiction (as opposed to a split of property jurisdiction, in a unanimous decision, the court upheld defining equalization payments as debts that are a claim provable in an insolvency process, meaning they are wiped off a person’s slate by the bankruptcy process.

Divorce during bankruptcy Canada: What should you do if you have both marital breakdown and too much debt?

Marital breakdown and bankruptcy is an extremely complicated process, made even more complicated when put together with divorce and requires a qualified licensed Trustee to work with your family law legal professional to work with your individual situation and give practical alternatives and an action plan. If you have serious debt problems, are considering bankruptcy and divorce, or perhaps wish to know more about marital breakdown and bankruptcy, then contact Ira Smith Trustee & Receiver Inc. as soon as possible. Starting Over, Starting Now, we can help you get your life back again on track, even with marital breakdown and personal bankruptcy looming.