Canada middle class size: Introduction

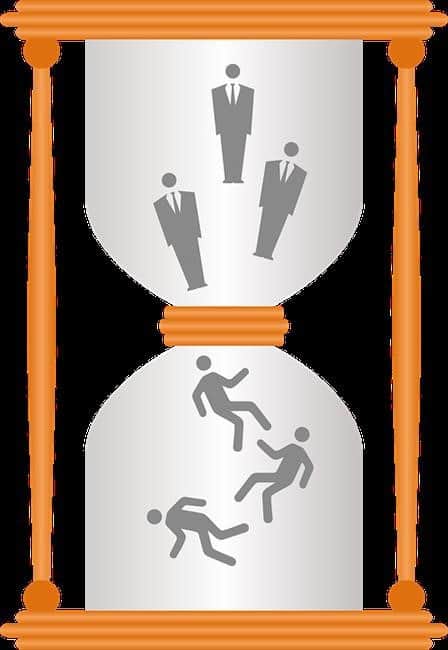

Most Canadians think of themselves as being “middle class”; however that seems to be changing. According to an Ekos-Canadian Press poll, Canadians who self-identify as working class poor are on the rise. The increase seems to be at the expense of the Canada middle class size. This same poll suggests people are feeling more pessimistic about their own futures not just over the next year, but over the next five.

Canada middle class size: The old Canada middle class definition

We used to define middle class as the median in household net worth, but this too, has changed. Middle class has now morphed into more of a state of mind than a demographic bracket. We now tend to think of middle class as a lifestyle and a value system – hence the expression “middle class values”.

This belief in middle class being a lifestyle is contributing to an increasing debt load for many Canadians. According to a recent CIBC poll:

- Many Canadians seems uninterested in prioritizing needs over wants

- Only 50% of those surveyed were willing to cut spending on non-essential items to keep up with bills

Canada middle class size: Canadian average household debt

The sad truth is that regardless of whether you’re middle class as a demographic bracket or a lifestyle, Canadians are now carrying more debt than those of any other G7 nation. Many are spending as much or more than they earn and as a result spreading things so thin that they’re living paycheque to paycheque.

In a recent survey by Canadian Payroll Association, almost 48% of respondents admitted they wouldn’t be able to make ends meet if their paycheques were late even by a week.

Canada middle class size: Is your debt pushing you away from the middle class

Are you getting deeper in debt trying to maintain your middle class lifestyle? If so, you need professional help before your house of cards comes tumbling down. I strongly recommend that you contact a professional trustee as soon as possible. Ira Smith Trustee & Receiver Inc. can help, no matter how dire your situation seems. With immediate action and the right plan, we can solve your financial problems Starting Over, Starting Now. Give us a call today.