Bad credit payday loans: our constant warnings

Bad credit payday loans: our constant warnings

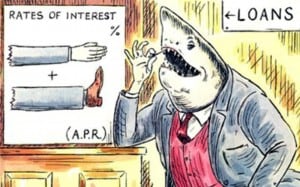

We’ve been warning you about the evil ways of the bad credit payday loans industry, and now a class action lawsuit in Ontario has begun. The payday loan industry should not be allowed to run. We’ve written about these unscrupulous payday loan companies at length and in-depth to serve as a warning.

- Canadian Payday Loans: 546 Reasons We Need Tough Federal Rules on Payday Lenders and 1 Possible Solution

- Online Payday Loans Toronto: Google Finally Realizes Its Huge Mistake!

- Payday Loan Companies: Are You Into Pawn?

- Payday Loan Companies – Update

- Payday Loan Companies: There are Options

- 10 Ways a Payday Loan Charges Illegal Interest

- Bad Credit Loans Toronto: Legit Companies Don’t Guarantee Them

- Bad Credit Loans Online Attack the Already Vulnerable

- Payday Loan Companies Targeting You With Mobile Apps!

- Canadian Payday Loans No Credit Check: Too Good To Be True!

- Payday Loans: Ontario Cracks Down on the Cash Store

- Payday Loans are Not the Answer to Your Financial Problems

How big is Canada’s bad credit payday loans industry?

Canada’s payday lending market is worth more than $2.5 billion.

How many Canadian use bad credit payday loans companies?

The latest estimate is that 7% – 10% of Canadians use payday loans. In fact payday loan companies made 1.3 million loans in 2013.

What’s the good news for victims of bad credit payday loans companies Cash Store or Instaloans?

I was astounded to learn that 100,000 Ontarians borrowed from Cash Store (no longer in existence) or Instaloans. Anyone in Ontario who took out payday loans or lines of credit (which were payday loans in disguise) from Cash Store or Instaloans after September 1, 2011 can take part in a $10 million class action law suit to recover some of the illegal fees and interest charged.

How can I get in on the class action law suit against Cash Store or Instaloans?

Jon Foreman, partner at Harrison Pensa LLP, is representing class action members. They have set up a website called takeyourcashback.com and there is a form which must be completed by the Claims Filing Deadline, October 31, 2016.

How much money will I get back?

It’s not certain. If your claim is approved you’ll be eligible to receive at least $50. However, if you took out multiple loans you could receive more. The final amounts will depend on how many claims are submitted.

Take advice from a GTA insolvency trustee and don’t ever go to a payday loan company! There are better options out there. Payday lenders will only trap you in a never-ending cycle of debt. Ira Smith Trustee & Receiver Inc. can help get you actually solve your problem by getting you out of debt and on the road to financial recovery, Starting Over, Starting Now. We’re just a phone call away.

Canadian payday loans – The Problem

Canadian payday loans – The Problem Online payday loans Toronto – What was Google’s mistake?

Online payday loans Toronto – What was Google’s mistake?