Sears Canada is closing: Introduction

It is the end of a Canadian retail symbol. Sears Canada is closing every one of its remaining 130 stores. After 65 years of business in Canada, Sears Canada is closing.

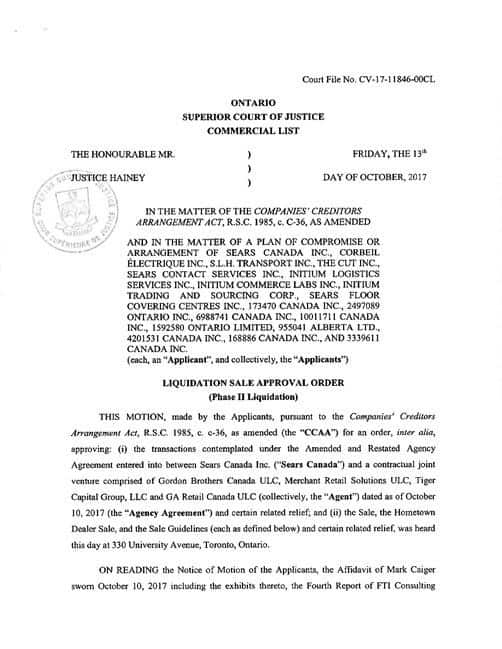

On Friday, October 13, 2017, the Ontario Superior Court of Justice Commercial List, under the Sears Canada CCAA process, issued the liquidation order. The final Sears Canada liquidation sale will begin and then the final Sears Canada stores closing happens. The reason for this is because there were no practical Sears Canada bids for the Court to consider from the entire bid process. The only alternative was complete liquidation. So the Court has now ordered that Sears Canada is closing.

Sears Canada is closing: I hate to say I told you so, but on June 21, 2017…

I gave the history of Sears Canada in my June 21, 2017 vlog, SEARS CANADA CLOSING DOWN: THE SEARS CANADA NEWS RELEASE LEADS ME TO THIS CONCLUSION. I also talked about the problems today in the North American retail industry and provided my personal belief that:

“Sears Canada are as good as finished. It is just currently an issue of time before the last pieces are marketed and sold.”

So, that we now know Sears Canada is closing is not a surprise to me or my readers.

Sears Canada is closing: I hate to say I told you so, but on August 2, 2017…

In my August 2, 2017 vlog, SEARS CANADA NEWS TODAY: ARE THEY SABOTAGING THEIR OWN RESTRUCTURING?, I talked about the public backlash at that time. I spoke about the social media campaign against the Sears Canada key employee retention program (KERP) proposed payments to senior management.

This KERP program implementation happened while the ordinary Sears Canada employees and retirees were being hurt. They knew they were not going to receive all of their benefits and pension payments or any severance or termination pay.

I then provided my personal assessment that:

“You must wonder if Sears Canada really wants to restructure, or if they are just liquidating their inventory. They are also trying to sell whatever other assets they can. If it was a true restructuring, you would think that senior management would want to see more customers who would be loyal to (the new) Sears Canada when it would exit bankruptcy protection.”

We now see that there is no possibility of restructuring. Just a Sears Canada liquidation and then Sears Canada is closing. I am proud of my professional opinions. However, it gives me no joy to see that the remaining 12,000+ Sears Canada employees will for sure now end up on the Sears Canada list of creditors.

Sears Canada is closing: I hate to say I told you so, but on September 27, 2017…

In my September 27, 2017 vlog, “TORONTO BUSINESS BANKRUPTCY PROTECTION: NDP WANTS FEDERAL INSOLVENCY LAWS CHANGED SO THERE IS PENSION PLAN SECURITY WHEN FINANCIALLY TROUBLED BUSINESSES FAIL”, I told you about Hamilton Mountain MP Scott Duvall. He is the New Democrats’ pension plan critic. He said that he will present a private member’s bill to secure employees’ pension plans and benefits. His bill will also pressure business to offer termination or severance pay, prior to paying secured lenders.

Mr. Duvall anticipated that Sears Canada is closing. We will have to see if his effort gets any traction.

Sears Canada is closing: The liquidation agreement

The Company intends to begin the liquidation sales by today. So you’re going to see offers at existing Sears Canada stores. Many of the store employees will keep their job during the liquidation. However, most of the 800 or so staff members at Sears head office in Toronto have now been let go.

Sears Canada became part of an Agency Arrangement with a legal joint venture. It consists of:

- Gordon Brothers Canada ULC;

- Merchant Retail Solutions ULC (collectively, with Tiger Capital Group, LLC and GA Retail Canada ULC.

The liquidation agreement dated October 7, 2017 has arisen from the solicitation procedure. BMO Nesbitt Burns Inc. (“BMO”), the Sears Canada financial advisor, obtained proposals from 7 prospective liquidators. The liquidation proposals were to help the Sears Canada Group with liquidating the inventory, furniture, fixtures and equipment remaining throughout Canada.

Sears Canada is closing: How the liquidation will work

The liquidation is to begin no later than October 19, 2017. The liquidation sales will continue for 10 to 14 weeks. The outside day for finishing the liquidation sale right now is January 21, 2018.

The liquidation will take place at all remaining Sears Canada full-line and home store locations. It may also happen at some of the Sears Canada distribution centres. Sears Canada will receive a guaranteed minimum recovery of:

- 83% of the cost value of the inventory included in the liquidation sale at the full-line stores; and

- 52.5% of the cost value of the inventory included in the liquidation sale at the Sears Home stores, subject to certain exceptions.

You may be able to snap up some bargains to put under your Christmas tree as Sears Canada is closing.

Sears Canada is closing: The honouring of Sears Canada gift cards, gift certificates, merchandise credits

Although Sears Canada is closing, gift cards and certificates and merchandise credits are honoured. No gift cards or certificates will be sold. Returns will not be allowed when it comes to any kind of goods offered throughout this Sears Canada liquidation process or the liquidation approved earlier by the Court on July 18, 2017. The Company will then have a time period to clean up and vacate the stores while Sears Canada is closing.

Sears Canada is closing: A Sears Canada warranty won’t be honoured

As far as warranty claims, if the warranty is from a third-party, then you may claim on any warranty for a product purchased at Sears. If it is a Sears Canada warranty, then you are out of luck. That warranty is now worthless because Sears Canada is closing.

Is your business showing early warning signals of financial problems? Are you scared that it too may have its own “Sears Canada is closing” scenario?

If you’re trying to find a way to reorganize your company’s financial debt, call Ira Smith Trustee & Receiver Inc. Don’t wait until it is too late and corporate bankruptcy is the only answer. If we meet with you early enough, we can develop a Sears Canada chapter 11 like restructuring and turnaround plan. The plan will be to save your company and the jobs of many people. It does not have to end in a “Sears Canada is closing” scenario.

Our technique for every person is to develop an outcome where Starting Over, Starting Now happens, beginning the minute you stroll in the door. You’re just one call away from taking the essential action steps to get back to leading a healthy and balanced stress and anxiety free life.

Types of Internet Scams: Introduction

Types of Internet Scams: Introduction Saving for retirement in Canada: Introduction

Saving for retirement in Canada: Introduction Managing your personal finances: Introduction

Managing your personal finances: Introduction

Economic indicators: Introduction

Economic indicators: Introduction