STUDENT DEBT: HOW TUITION COSTS AND DEBT NEGATIVELY AFFECTS US

Student debt: The times have changed already!

Times have changed so much for university graduates and unfortunately, student debt counselling has not kept pace with today’s reality. Students graduate with various student loans and varying amounts of debt. The theory is that graduates will get a well-paying job in their chosen field upon graduation, allowing them to work and to repay their student loan debt.

Our previous student debt counselling and student loans blogs and vlogs

Student loan debt is such a serious issue that we’ve written a series of blogs and vlogs on the subject:

- STUDENT DEBT COUNSELLING: ARE WE DOING ENOUGH TO REDUCE THE COST OF STUDENT LOANS?

- VIDEO: DREAM CRUSHING AVERAGE STUDENT LOAN DEBT: REASONS WHY WE PITY YOU

- STUDENT LOAN DEBT, DOES IT AFFECT THE ECONOMY?

- STUDENT LOANS DEBT: WILL BANKRUPTCY ELIMINATE IT IF YOU ARE NOT THE STUDENT?

- STUDENT DEBT BANKRUPTCY: NEW SECRET TACTIC TO AVOID BANKRUPTCY

- CANADIAN PARENTS PAYING STUDENT LOANS

- PARENTS PAYING STUDENT LOANS: SHOULD YOU BORROW FOR YOUR CHILD’S POST-SECONDARY EDUCATION?

- CANADA STUDENT LOAN REPAYMENT: WHAT CAN YOU DO IF YOU CAN’T REPAY?

Student debt: What can today’s graduates expect?

However, in today’s world, their job searching may result in them not getting immediately into their field at the salary they anticipated. It may be the case that graduates may have to do a couple of different part-time jobs, may start being underemployed and in some cases, starting out interning and being in their chosen field but not being paid at all. This will put immense pressure on the new graduate who needs to start repaying debt in addition to normal living expenses.

Student debt: How much of a problem is it really?

Post-secondary education is effectively a need to succeed in today’s labour market. Unfortunately, while the demand for education has increased, public funding has failed to keep up.

According to the Canadian Federation of Students, public funding shortfalls have resulted in a significant growth of costs that students must now bear, namely in the form of high tuition fees. From 1990 to 2014, national average tuition fees have seen an inflation-adjusted increase of over 155%. In Ontario, tuition fees have increased over 180%.

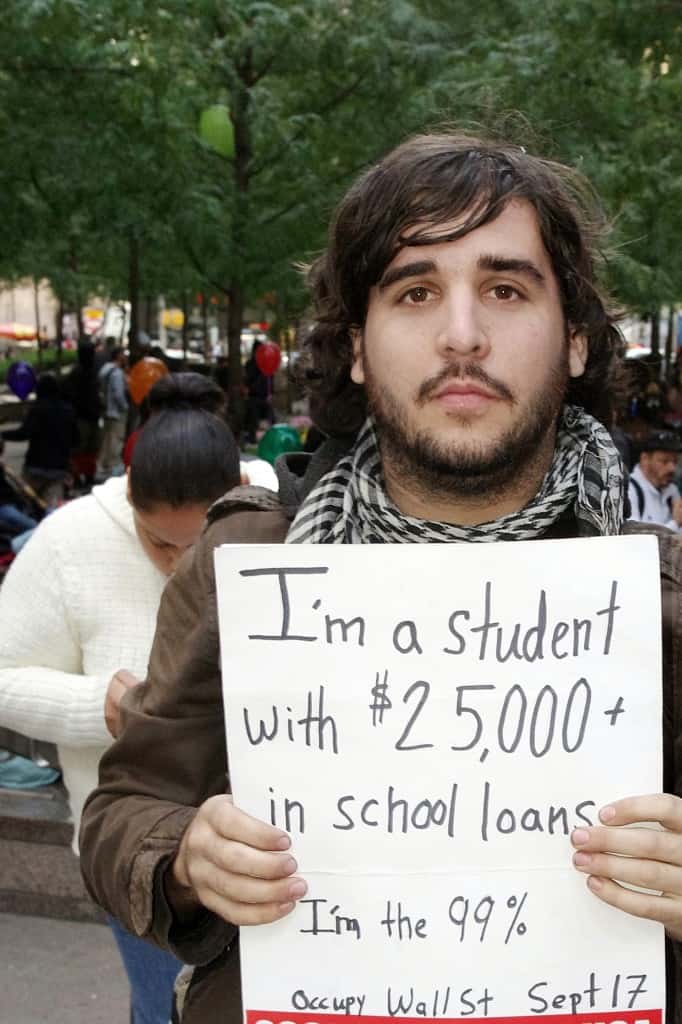

They also state that students who receive funding through the Canada Student Loans Program (CSLP) are graduating with an average student loan debt of $28,495. This is only student loan debt and doesn’t include any other borrowings for living expenses if the student is living away from home. The impact of Canada student loan debt is that today’s students are the most indebted generation in Canadian history. They can certainly use student debt counselling.

Student debt: We need more than just counselling

Although financial counselling should begin at home at a very young age, and be reinforced through teachings at the high school level, more than debt management lessons are required. We need our provincial and federal governments to take the lead. There needs to be an easing of the burden on graduates. Graduates with high student loan debt show signs of poor mental health in early adulthood. This certainly must impact their work performance and is not healthy for Canadian society.

Our governments need to look seriously at the public funding model for post-secondary school education. It is not helping Canadians to allow them to incur high student debt for fields of study where the job prospects, and the prospect of being able to repay the loans, are dim. It does not help Canadian graduates to have them under so much pressure to repay loans after graduation – perhaps there needs to be federal government intervention to ease the repayment program. In this way graduates can have the necessary time to get their employment, contribute to Canadian society, pay income taxes AND repay student loans.

These are just but a few simple ideas. I am sure that you can come up with many more and I would love to hear about them.

Are you in need of student debt counselling or credit or debt counselling in general?

No matter the cause of your serious debt issues, The Ira Smith Team is here to help. Debt is not insurmountable; there are always options. With proper counselling, immediate action and a solid plan, we can help get your life back on track Starting Over, Starting Now. Our trustees are also certified in credit counselling. Give us a call today.

THIS VLOG WAS INSPIRED IN PART BY OUR eBOOK – PERSONAL BANKRUPTCY CANADA: Not because you are a dummy, because you need to get your life back on track